Articles about Health Insurance that may be useful to Massachusetts retirees

Opposing GIC Cost Shifting

February 12, 2026Breaking NewsThe following is an open letter sent by Mass Retirees to the Group Insurance Commission in opposition to what we ...Read More - Opposing GIC Cost Shifting

Proposed health care plan changes for state employees a big step backwards

February 9, 2026From the MediaBy Jamie Hartmann-Boyce & Theo Schall Rising health care costs pose an existential threat to the well-being of ...Read More - Proposed health care plan changes for state employees a big step backwards

Mass. municipalities & school districts hit hard by rising health insurance costs

January 5, 2026From the MediaBy James Vaznis, Globe Staff Escalating health insurance costs turned into a budget nightmare this academic year for Pioneer Valley ...Read More - Mass. municipalities & school districts hit hard by rising health insurance costs

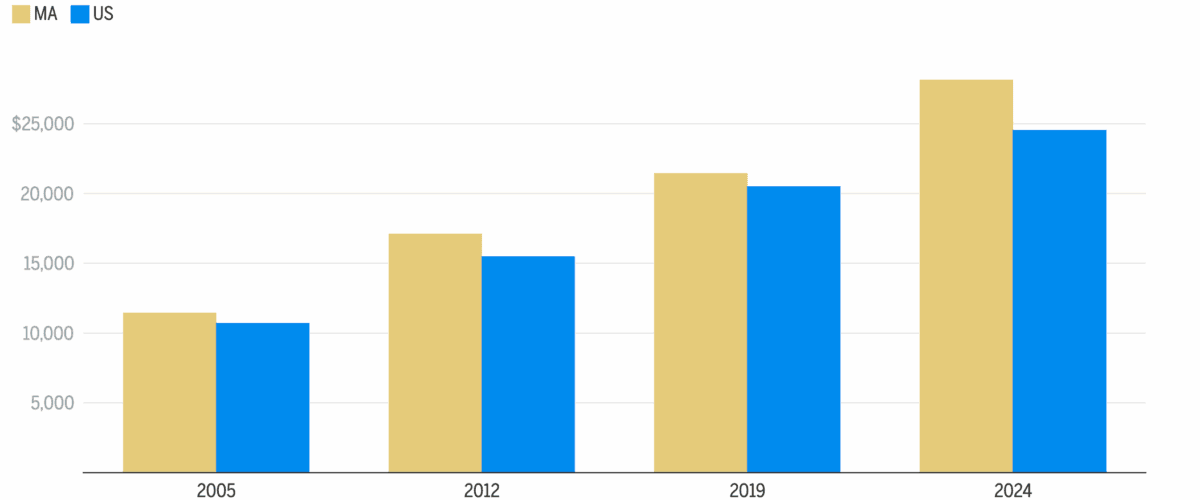

‘We’re at a breaking point’: Health insurance premiums just keep going up, worsening affordability crisis

November 28, 2025From the MediaBy Jessica Bartlett and Marin Wolf Globe Staff Each time one of Tamara Modig’s children needs a telehealth appointment ...Read More - ‘We’re at a breaking point’: Health insurance premiums just keep going up, worsening affordability crisis

Outlook For The Next Six Weeks

November 7, 2025Weekly News UpdateThis week, we have a short update regarding our focus over the next six weeks leading up to the holiday ...Read More - Outlook For The Next Six Weeks

Turning 65 and Medicare Enrollment

October 13, 2025Breaking NewsWith Medicare’s annual Open Enrollment period about to begin on October 15, this is a good opportunity to revisit ...Read More - Turning 65 and Medicare Enrollment

Retiree Health Insurance Developments

October 3, 2025Breaking NewsWeekly Update, October 3, 2025: This week our focus returns to retiree healthcare, both at the state and municipal levels ...Read More - Retiree Health Insurance Developments

Medicare 2026 Part B Premiums: Projected Double Digit Increase

September 9, 2025NewsLater this fall CMS (Centers for Medicare & Medicaid Services) will be announcing the Medicare Part B Premiums for next ...Read More - Medicare 2026 Part B Premiums: Projected Double Digit Increase

Healthcare Affordability: As Collaboration Takes Shape

September 6, 2025NewsOur lead article in the July edition of The Voice was an editorial spelling out our deepening concerns regarding healthcare ...Read More - Healthcare Affordability: As Collaboration Takes Shape

The urgency of tackling health care affordability

July 28, 2025From the MediaThe system is buckling under the weight of soaring costs of drugs and medical care by SARAH ISELIN, president and ...Read More - The urgency of tackling health care affordability